Buy land as they aren’t making it anymore.… A famous quote often attributed; like many other quotes, to Mark Twain.

Regardless of who said it there is a fundamental truth to the saying.

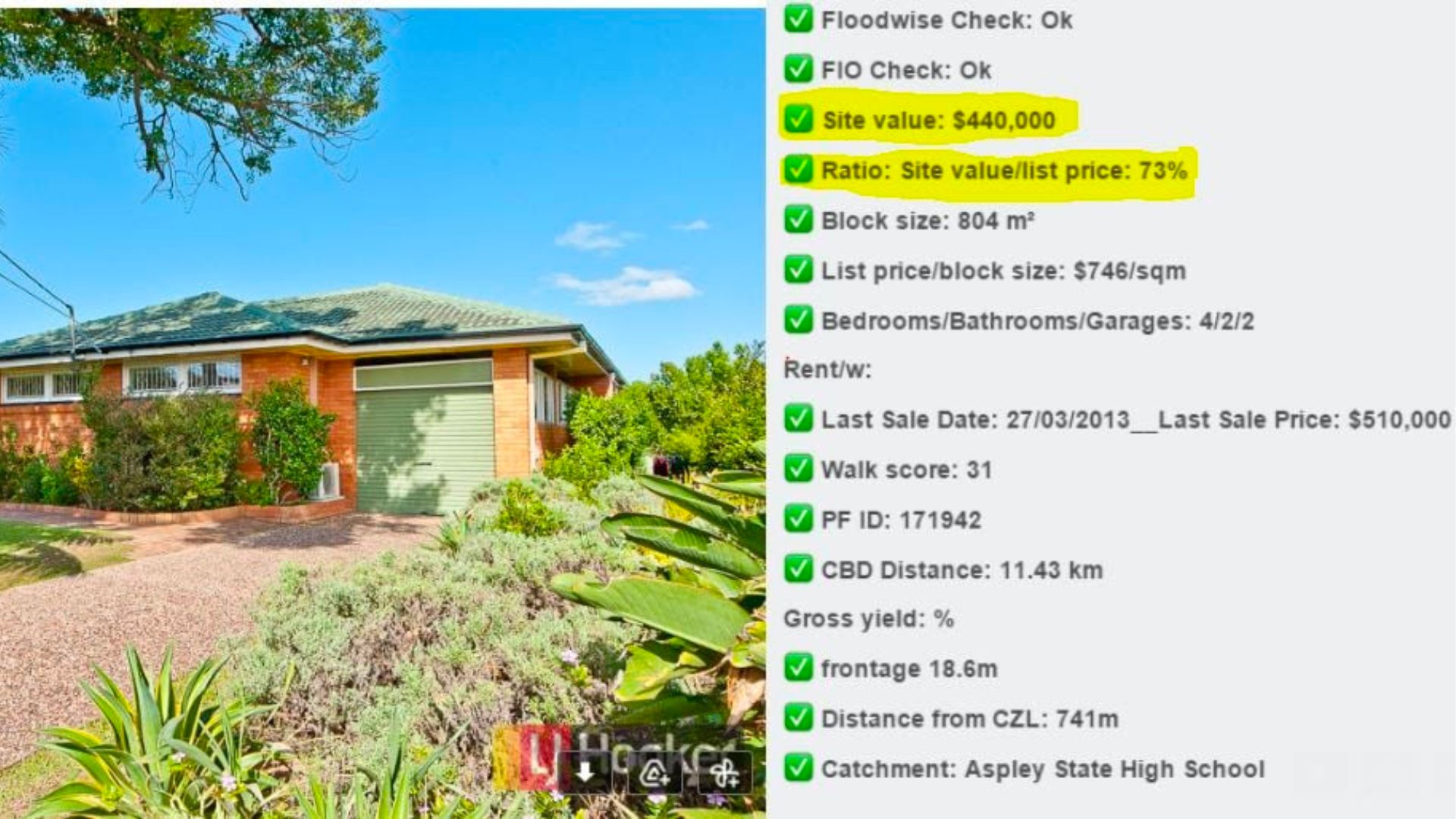

Every property we research and checklist at Allen Real Estate looks for the land value underpinning the deal. We look in particular at the land value ratio. If a property is listed for sale at $600,000 and has a $300,000 site valuation then the land value ratio would be 50%.

I have been using this idea in my own investing since the early 2000’s and am glad there is much more awareness of it now with investors.

We consider that deals with strong land value ratios are well positioned to outperform with capital growth longer term.

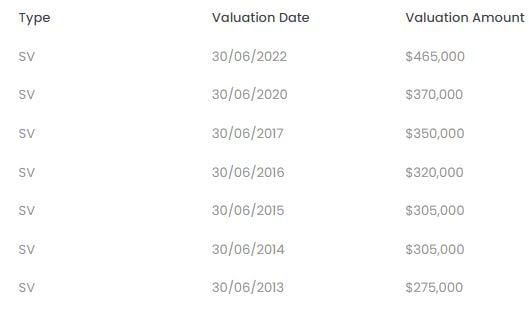

The easiest way to benchmark properties is to use the council supplied valuations for the land.

Site valuations are usually conservative.

The land might sell for 20-30% more on the open market. Council needs the site valuations to keep increasing as this keeps their income, council rates based on site values, rising also. If they increase the values too much they will face complaints from the community however.

The ratio is a reasonable overall tool and an excellent comparison tool. A higher ratio doesn’t always make a better investment, there needs to be a balance between the value of the land and the value of the house as the house is what will be generating your rental return (yield) and helping with your holding costs while you wait for the capital growth genie to arrive.

Comparing different properties and areas and price points can be assisted nicely by looking at the ratios for each property. If older established houses are selling around 70% land value and new houses are selling on 30% to 40% land values then you need to carefully consider what weight you are placing on initially higher yield and better depreciation (for the newer house) over the longer term.

Like all guidelines and rules of thumb, this idea needs to be adjusted for every property as the specifics of a property deal are always highly individual.

Every property has land value.

Strata properties will have an underlying land component also. A 6 pack unit block may be placed on land worth 1.2M which gives each unit $200,000 in land value.

A low land value ratio can signal future competition issues At the core with a market, everything is always based on supply and demand forces. Demand is very easy to work out… buy in capital city with a growing population… done… Supply on the other hand is somewhat more complex. When you buy in an area that has a lot of potential future development nearby, large housing estates being built on newly developed land you also have a lot of future competition for your tenants and buyers for your property.

There are a few more very important considerations to season the recipe here which I’m always happy to talk about if you would like to learn more.